Insurify Review

Table of Contents

About Insurify

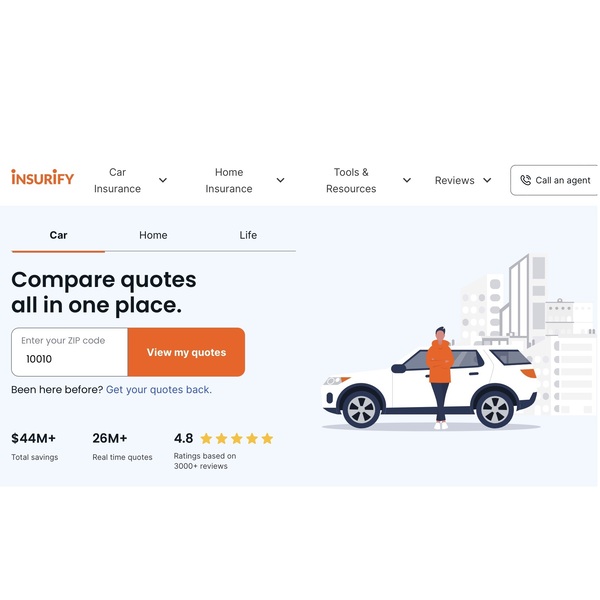

What if I told you you could get 10+ insurance quotes from top-ranking companies in two minutes flat and save up to $966 per year? You’d probably ask what the catch is. Well, there isn’t one—that’s simply what it’s like to use Insurify.

A free online marketplace that helps you find money-saving insurance plans, Insurify is an AI-powered tool that takes away the hassle of shopping around. It’s won awards almost every year since launching in 2013, nabbing trophies from FinTech Global, Deloitte, EY, and more for its innovative, game-changing approach.

Is it really that simple? In short, yes, but to learn the who, how, and why behind what’s made it such a success, check out this Insurify review. Here, I’ll tell you all about what the company offers, what customers think, and more.

Overview Of Insurify

The year was 2013 and Snejina Zacharia had just launched Insurify after witnessing her car insurance rates rise after a small accident. With the intent to switch providers, she set out on a long and frustrating process that required too many phone calls and involved way too much spam.

In her first year at Insurify, Zacharia was a finalist at MIT’s $100K competition. A few years later, she won Acord’s Insurance Disruptor of the Year award and The Best Insurance Website of 2016.

How? Because her website totally reinvented the way we shop for car, life, and home insurance, and though today it sounds like a simple, no-brainer to use a comparison service, in 2013, the concept was revolutionary. And while other competitors have emerged over the years, Insurify remains “the top-rated insurance comparison marketplace on the internet.”

Now that you know a little more about the who and why let’s focus on the how. The highlights are up next, then we’ll dive right into this Insurify review.

Highlights

- Get 10+ quotes from top-rated insurance providers

- Personalized quotes

- Saves you up to $966 per year

- Takes five minutes max

- Totally free

- 100+ insurance partners

- Available in all 50 states

Now you’ve seen the brand from afar, but coming up in this Insurify review, we’re going to get nice and cozy with it. There’s a ton to unpack—including details on its comparisons, coverage options, and how it all works—so let’s get started.

Insurify Insurance Review

Insurify offers comparisons for auto, home, life, and even renter’s insurance. Considering the alternative—calling up each individual provider, hearing their spiel, and taking notes—it’s kind of crazy how easy it is to get 10+ quotes in two minutes. And after you’ve found a plan that’s right for you, you can buy it directly online. Plus, the whole process takes five minutes tops.

So how does Insurify do it all? It uses a patented algorithm called RateRank™ to gather the information that you’ll provide, virtually consult with insurance companies and learn what they have to offer, then show you plans that are right for you. It’ll even show you the discounts each provider offers.

And guess what? It does it all for free—without stealing or selling your personal information. On average, Insurify customers save $489 per year and up to $966 per year. With all of those exciting facts in mind (yes folks, shopping for insurance can be fun), let’s move this Insurify review right along.

Insurify Car Insurance Review

Insurify car insurance is one of the service’s most popular tools. Letting you compare quotes that are personalized based on you and your car, you’ll answer a few questions and get quotes in a matter of minutes.

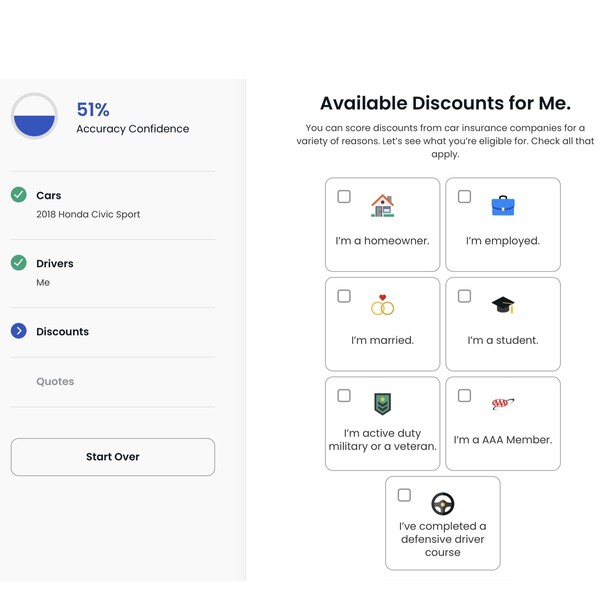

The cool part about using Insurify is that not only does it show you your options to help you save, but it shows you your discounts too. So you’ll be able to see which company will offer you more discounts, which may impact your final decision. In fact, you can shop online or on the phone and save up to $966 on annual premiums.

Insurify Quote Comparison Review

Similar policies can be differently priced, which is why it’s important to look at your options side by side. Luckily, Insurify does this for you, saving you the time and headache it takes to enter your information into 26 different websites and get a single quote from each one.

By collecting relevant information about you, your car, or your home, Insurify’s AI tool “presents” these to insurance companies who “come back” with a quote. Plus, it takes just a few minutes and you’ll be able to compare one against the other.

Since companies weigh certain factors—like age and education level—differently, these numbers will affect your overall quote. Meaning, you can get a much lower price than you thought possible. It’s always worth a look.

Insurify Coverage Options

Insurify offers comparisons for auto, home, and life insurance policies. For auto insurance, you’ll have quite a few options. So I’ll list them all below.

- Full coverage: liability, comprehensive, and collision coverage

- Temporary: coverage for less than six months

- Gap: if your new car is worth less than your outstanding loan payments

- Liability coverage: the very least type of coverage you should have—by law!

- Uninsured or underinsured motorist coverage: coverage when other drivers are at fault during an accident

For life insurance, you’ll pick how long of a term you’d like (10, 15, 20, 25, 30 years) and your preferred coverage amount. Home insurance isn’t categorized into coverage options. Instead, it’s based on many different factors about your home.

How Does Insurify Work?

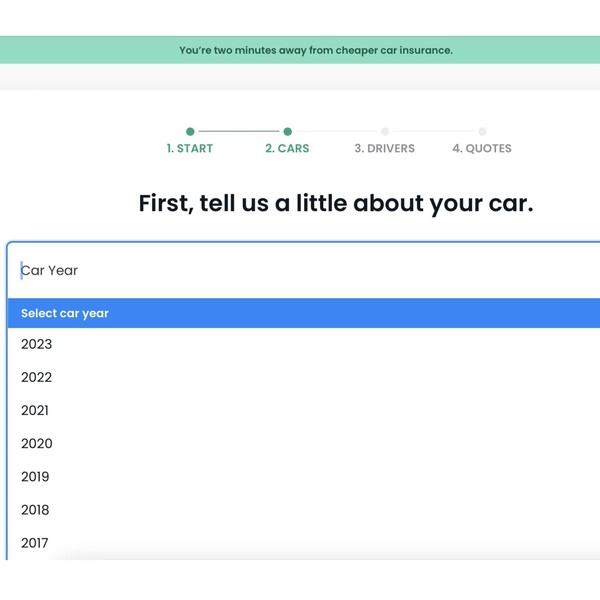

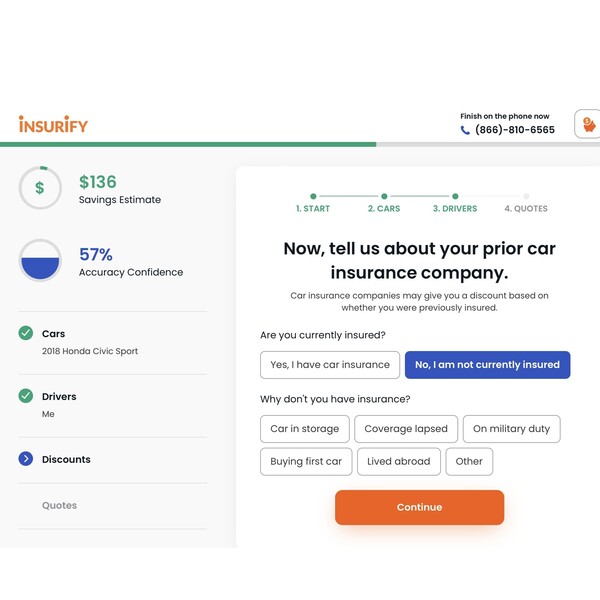

Insurify is all about getting you the right insurance plans. That means taking your needs into account and showing you your options. To get started, select auto insurance, enter your zip code, and click ‘view my quotes.’

You’ll be led to another page and asked about the year, make, and model of your car. You’ll also be asked what you primarily use it for, how many miles you drive daily, your car payment status, and if you’d like full coverage or not.

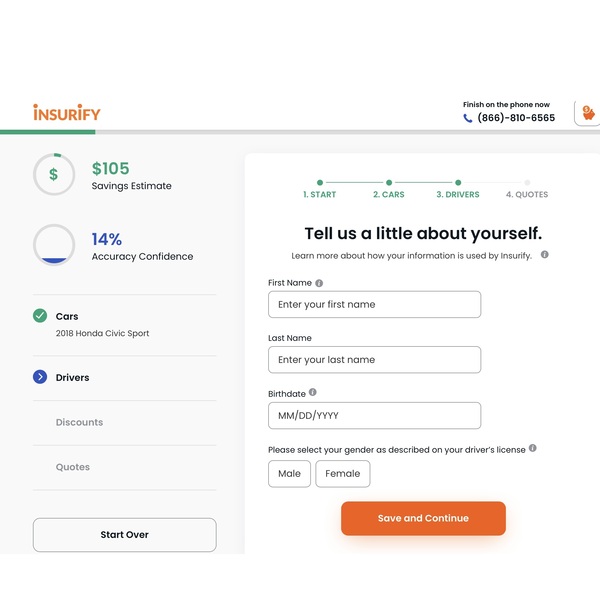

Then you’ll enter the driver’s info. Tell them your name, birthdate, and gender that appears on your license. Also, let Insurify know the status of your license, how old you were when you got it (in the US), and what your credit score is.

It’s a lot of information, I know, but it all plays a part in determining your final quote. Next, choose your highest level of education and click ‘save and continue.’

Now comes the fun part—the discounts. Select all that apply to you. Then, write down who your current car insurance provider is, how long you’ve been with it, and what the bodily injury limits are on your current policy. It’s okay if you don’t know.

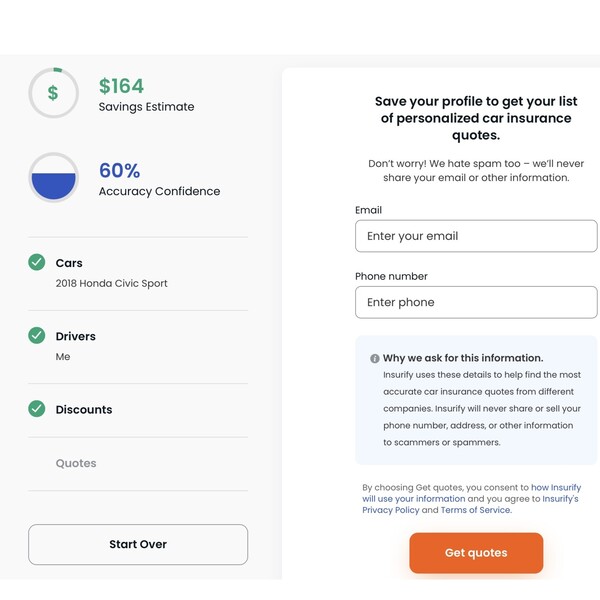

Finally, report any accidents or insurance claims you’ve had in the last five years, enter your email, and get your quotes.

Keep in mind that Insurify isn’t an insurance provider. It simply connects you to a variety of insurance providers. So, going forward, you’ll need to deal directly with the provider you’ve chosen anytime you wish to make a claim or change your policy.

Which Insurance Companies Does Insurify Partner With?

If you’ve heard of an insurance company, chances are that Insurify partners with it. In fact, Insurify has teamed up with over 100 different insurance companies to ensure you know all your options and are getting the right plan for you.

Here are just a few of them:

- AARP

- AIG

- Allstate

- American National

- Geico

- Liberty Mutual

- State Farm

- The General

Who Is Insurify For?

Insurify compares car, home, and life insurance plans and shows you your options. As an online tool or over the phone, it’s a great choice for anyone that wants an easier (and less expensive) way to get insurance.

Insurify Reviews: What Do Customers Think?

Ratings are super important to Insurify and they’re equally as important to this Insurify review. On Insurify’s website, you can view scores for all of the insurance companies it’s partnered with. For example:

- Hartford has 4.7/5 stars from 29,516 customers

- Esurance has 4.5/5 stars from 4,728 customers

Overall, on Insurify.com, users give the service 4.8/5 stars and there are over 3,000 reviews. On WalletHub, 77 shoppers awarded the brand 4.3/5 stars, while 3,289 of them gave it 4.8/5 stars on Shopper Approved.

On Shopper Approved, here’s what one reviewer had to say: “I’ve never dealt with anyone like Christy before. She is genuine and kind, making a necessarily complicated process a breeze. I am very grateful for her warmth and humanity. She treated me with much respect and had me enjoying the insurance-buying process. What a pleasant surprise!”

There are literally thousands of positive reviews about how helpful Insurify’s customer service team is, and it looks like for this reason, many prefer getting their insurance quotes over the phone.

As for the online process? “Not complicated,” wrote one user who said they appreciated “the ability to actually get an online quote without waiting for someone to call back.” In fact, the multi-pronged approach is one of the reasons Insurify has been such a success.

Customers who took the time to leave a review on Clearsurance agreed. One Insurify reviewer left this positive comment: “great experience good people quick service great I was very satisfied and will continue to use them.”

139 people left ratings on Clearsurance, awarding the brand 3.7/5 stars overall. This next Insurify review we’ll look at mentions one of the other benefits of using the service. Here it is: “I lowered my insurance payment by almost $40!!! I NEVER thought my insurance would be under $100 with having the SR-22 but it is.”

Great customer service, the ability to save money, an easy-to-use tool—is there anything else you could really ask for in a free service? Probably not, but let’s take a look at one last Insurify review for good measure.

This one comes from the Better Business Bureau where Insurify has 4.73/5 stars, 91 reviews, an overall A+ rating, and 0 complaints.

“[Agent] was so patient and helpful with the entire process. He took the time to explain every detail, addressed all of my concerns and was able to get me a great insurance rate. I can’t express enough how easy he made this for me,” the Insurify review revealed, which pretty much backs up everything we’ve read so far.

All in all, it’s easy to see why Insurify has won so many rewards and has saved users over $44M. With a kind, patient, and helpful customer service team, as well as an easy-to-use online tool that helps you save money, choosing Insurify is an easy choice.

Insurify Vs. Compare.com

When it comes to insurance, you’ve got options. And the same goes for insurance marketplaces like Insurify. To help you see what separates my featured brand from others out there, I’ll do a quick comparison between it and Compare.com.

Similar to Insurify, Compare.com helps you compare auto and home insurance across all 50 states. Compare.com also offers comparisons on health insurance, medical procedure, and auto load costs—whereas the only other service Insurify offers is life insurance.

Furthermore, Compare.com has 75 insurance partners. Insurify has over 100. So, it looks like Insurify has more extensive guides about how insurance works and how to pinpoint a company that’s right for you. Finally, both offer easy-to-use online tools, but unlike Insurify, Compare.com doesn’t offer quotes over the phone.

Is Insurify Legit?

Insurify isn’t just 100% legit, it’s also an award-winning service praised by thousands of users. Some customers reported issues with using the online tool, but if you do, just give Insurify a call. I’ve read in Insurify reviews that its customer service team is off-the-charts helpful.

Is Insurify Worth It?

I’ve packed a ton of info into this little ol’ Insurify review so let’s do a quick recap. Insurify shows you all of your insurance options in a matter of minutes, is super easy to use, and saves you hundreds of dollars each year. Oh yeah, and it’s totally free.

I mean, in terms of things that are worth it, this service tops the list. I also appreciate that Insurify has a stellar customer service team and that you can get your quotes in under five minutes because, honestly, who has time for moody agents and hour-long phone calls these days?

Insurify Promotions & Discounts

Insurify is free to use, and last time I checked, you can’t discount something that’s free. And while that may be so, Insurify does you one better by saving you an average of $489 annually. Hello, vacation fund!

How To Sign Up On Insurify

Getting started with Insurify is a simple six-step process. I’ll walk you through the whole thing so there are absolutely no surprises.

- Go to Insurify.com

- Enter your zip code and click ‘view my quotes’

- Let them know what your current insurance status is

- Enter details about your car, home, or life

- Tell them about yourself

- See your quotes

FAQ

Who owns Insurify?

Snejina Zacharia founded and owns Insurify. In 2021, she was on the WPO’s list of Women 2 Watch.

How does Insurify make money?

If Insurify is a free service, how does it stay operational? By charging the insurance providers instead of the customers. I’m sure you know how competitive the world of insurance is, and since Insurify helps to connect these companies with new customers, they’re willing to pay a fee.

Is Insurify expensive?

The whole point of Insurify is to save you money and time. It’s not an insurance provider, it just shows you your options based on your personal, car, or home information. On average, those who use Insurify to help them find an insurance plan save around $489 per year.

So, no, Insurify insurance isn’t expensive—if you choose one of its more affordable options. How much you end up paying depends on your needs as well as your car, home, or coverage type.

Does Insurify have local agencies?

Insurify is a completely digital service. While you won’t be able to pop into a store and see one of its agents face to face, you can give them a call if you’d prefer to hear, instead of view, your quotes.

What is Insurify’s privacy policy?

To use Insurify, you’re required to enter personal information like your name and contact information. They will also collect personal information about you through third-party services, as well as navigational information, and log files.

Under no circumstances will Insurify share or sell your personal information unless you consent to it. And then, it’s only with the insurance provider you’ve agreed to go with.

The information they collect is used to provide you with their services and understand your browsing habits to better serve you. And you can disable the collection of certain types of data through your browser’s settings or by emailing [email protected].

What is Insurify’s refund policy?

What’s the cool thing about using Insurify? It’s a free service. You don’t actually pay anything to use it. Thanks to that little perk, Insurify doesn’t need a refund policy.

In general, insurance companies don’t offer refunds, but you can cancel your insurance plan at any time. Check out Insurify’s blog for thorough guides on how to cancel your current plan. They have a guide for just about every provider you can think of.

How To Contact Insurify

Do you still have questions after reading this Insurify review? If so, reach out to the brand directly by calling (866) 749-1973 or emailing [email protected].

Check out some of our recently published articles:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review