Revolut Review

In partnership with Revolut

Table of Contents

About Revolut

The blahs that come with managing your finances tend to pop up as the process becomes more complicated. Through exchange rates, account fees, cards, and more, it all gets stressful in seconds.

That’s why Revolut entered the scene in 2015 to simplify the system through one app. Just one location to control accounts, transactions, money transfers, investments, and everything else one could need in their financial life.

The company has blown up since first appearing on the market. Present in over 100 countries and with over 20 million users to their name, Revolut currently has over 164k followers on Instagram, and that’s just their main account.

Their name has appeared in Forbes, The Guardian, BBC, and more to showcase the range of services that this business provides for their users.

We understand that managing your finances can be a bit stressful, so this Revolut review will break everything down step-by-step. Checking out how the system works, services in place, competitors, and even customer ratings, we’re here to determine whether Revolut is the financial app to bet on.

Overview of Revolut

From day one, Revolut’s goal has been about bringing together savings, money transfers, and financial journeys into one simple process.

Putting customers before currency, this business wants to help people learn to use their money on every level to bolster accounts and long-term plans with the money they deserve.

Working from a single app, this business initially launched in the UK in 2015 providing money transfers and exchanges.

Now working globally, over 20 million users have access to personal and business accounts assisting them in financial intelligence, control, and health.

Connecting worldwide from a single screen, this brand is ideal for travelers, investors, and those looking to better understand the fascinating world of funds.

We understand that there’s a lot to discover here, so our Revolut review narrowed down a few top highlights from the company to consider.

Highlights

- Offers an all-inclusive app featuring a wide range of financial services options for users

- International money transfers at amazing rates

- No-fee cash withdrawal at 55k+ in-network ATMs

- No minimum balance or hidden fees

Revolut Card Review

We can’t just do a Revolut review on products, as this business works through multiple avenues to put pieces towards a larger process. That means we’re breaking down the system bit by bit to explain the larger goal and possibilities including both features, and fees, along the way.

Revolut Account Opening and Maintenance Fee

Before anything else in this business, the first step is always opening an account. Revolut offers three different plans, here are the plans available and their monthly subscription fees:

- Standard – No-fee

- Premium – $9.99/month

- Metal – $16.99/month

Opening an account takes minutes as the whole process is fully online. Just follow the guided steps online, putting in information as required and the account will be ready to use in minutes. Once everything is in place, and a physical card is ordered, the card will be mailed and arrive in just days. While you wait for your physical card to arrive, you can still use your account with a virtual card.

As for the differences between the cards, Standard offers all financial needs without worry. Premium and Metal get into more exclusive privileges with special edition cards, lounge access during layovers, and more.

Revolut Card Fees

The good news here – the first Revolut card is always with no fair usage fees (although faster shipping will incur a fee). Different levels of status provide access to different amounts of cards, however, the first physical card always comes included upon registering.

Those in need of something a bit more exclusive can check out the special edition cards available for an additional fee (cost dependent on the card and shipping).

Should something happen to the initial card, there’s no need to worry about it. Standard replacement cards are available at a cost of $5 per card. Just submit the request, pay the fee, and a new card will be on the way over in no time at all. Replacement cards for paid plans cost a bit more.

The only fee to keep in mind surrounding cards (other than for replacement cards) comes from delivery costs. Depending on the plan and shipping speed selected, costs can add up quickly. There are three shipping options available:

- Standard Delivery: $0-$5

- Expedited Priority Delivery: $16.99

- Global Express Delivery: $19.99

We’d always recommend standard delivery for the lower cost, but select what works for you. It’s good to keep in mind that while it takes a few days for the physical card to make its way home, virtual cards are available for use right away.

No stress, no waiting, just register and you’re good to go.

Revolut ATM Fees

Revolut works with 55k+ in-network ATMs to provide customers withdrawals of any amount without a fee.

Revolut doesn’t charge fees up to $1,200 per month in out-of-network ATMs. After reaching the limit, further withdrawals incur a 2% fee of the value withdrawn.

ATM operators and networks may issue their own fees which Revolut has no control over.

Revolut Transfer Fees

Transfer away with Revolut as money sent to other Revolut accounts issue no fee.

Payments sent to external accounts may have charges applied, however, should that take place users will be notified prior to the transfer of the amount required to complete the transaction.

Revolut Currency Exchange Fee

Perfect for travelers, businesses, and industry work, Revolut offers easy solutions to the stress of currency exchange. The Revolut app allows users to make exchanges based on the current market rate.

Rates used aren’t established by the brand, so this Revolut review can’t throw numbers into the equation. With that being said, we can assure customers that there’s no additional fee from the company on currency exchange during foreign exchange market hours. Unless you’re exchanging Thai Baht or Ukrainian hryvnia which have a 1% fee during foreign exchange market hours and 2% outside those times.

Revolut calculates its currency exchange rates from the buy and sell rates they have determined based on the foreign exchange market data feeds from a range of different independent sources. The only costs come from the foreign exchange market rates at the time the rate is calculated (unless transfer limits are reached, when additional fees apply).

Revolut Top-up fee

It’s all nice to have a card with quick access for withdrawals, but sometimes we need to top up that money to keep the good times going. Luckily, there are a number of ways to add funds to an account.

Customers can set up direct deposits for work or additional sources.

Those in need of just a quick transfer can add funds from a domestic debit card or bank transfer with no additional fees.

Funds coming in from international sources may be subject to a fee of up to 3% to complete the transaction. The same fee appears through the top-up stemming from commercial debit cards.

The easiest way to get the job done? Stay domestic. It’s no-fee, takes little time, and provides quick access to the new funds.

Revolut Account Opening Review

Now that we’ve covered more physical and personal elements of the account, we figured we should give some attention to the larger picture. Checking out the global availability, we’re diving into their international operations.

Revolut Countries

We’ll be honest, listing all available countries would take some time. Currently available in three areas of the world (Europe, Americas, and Asia Pacific), there are a lot of country names associated with this business.

At the time of writing this Revolut review, this company is present in over 35 countries worldwide with plans to expand to six more countries in the coming year.

Revolut Currencies

This company keeps things stocked when it comes to currencies. Currently offering over 120 currencies for exchange and transfer, the Revolut app ensures travelers are covered wherever they go.

Revolut Currencies in The App

Currencies for transfer through the app are similar to those on the site. For customers wanting to make a deposit or top-up through the app, here are the available currencies: AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HRK, HUF, JPY, NOK, PLN, RON, SEK, USD, ZAR.

Revolut Features Review

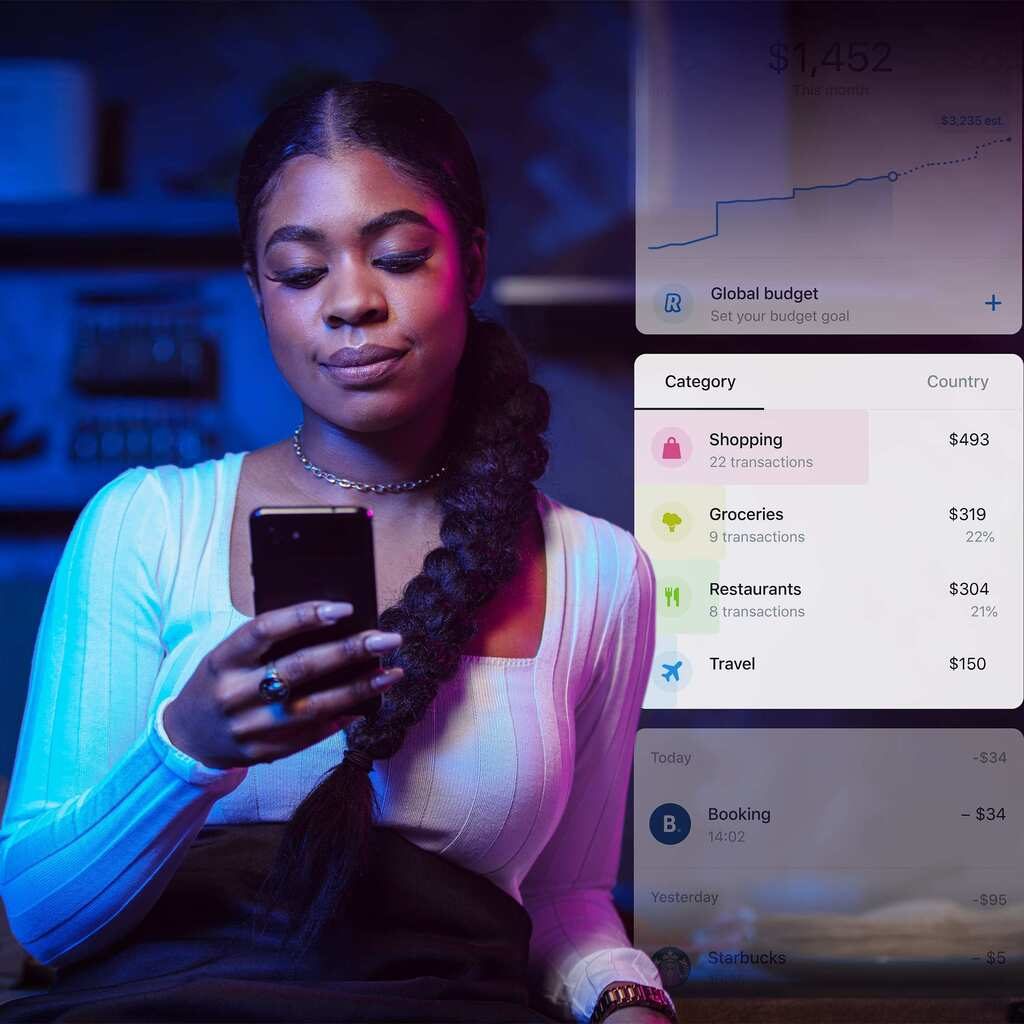

Revolut goes beyond the investment and depositing features available through this app. The beauty with this one tends to come through their transactions.

Revolut allows customers to make international purchases without having to pay usage fees and allows 10 no-fee global transfers per month. In addition to the financial aspects of the service, the control surrounding each account is a big winner.

Customers have complete access to all transactional history. Users are notified instantly upon payments made, making it easier to keep note of any fraudulent activity and boosting personal security.

Spend without any fear in place in knowing that all accounts are notified and tracked to put control directly into the customer’s hand.

Revolut Card Review

We’ve counted up the pros and cons for these cards and it’s time to wrap the facts up in one nice space. We have to acknowledge that the best part of this one comes from the no-fee access to both physical and virtual cards.

Virtual cards are set up in seconds, accessible with Google and Apple pay for easy spending. Premium and Metal cards are not free, but offer an additional element of security through the inclusion of disposable cards to prevent fraudulent activity and continual use.

As for physical cards, there’s a lot to explore with this one. Every level offered by Revolut comes with a no-fee physical card, but we really want to highlight the special editions. New designs appear constantly with the past ones consisting of the following:

- Rainbow

- AJ Glow-in-the-dark

- Poppy

- 24k Gold Plated

- Liam Payne Sunset card

With more cards available for purchase or replacement (at a cost), there’s a lot to discover with a Revolut card in hand.

Who Is Revolut For?

Anyone interested in financial services can check out Revolut for a world of financial education and health.

The Standard Plan is available to customers in the US, the UK, the EU, Australia, Singapore, Switzerland, and Japan. This business aims to help adults learn how to make their money work for them at the best cost – no-fee.

We know that not every element comes at no cost, but the amount available still serves as a great starting point for those interested in expanding their financial literacy.

Revolut Reviews: What Do Customers Think?

We can’t send customers into the deep end without committing to further research. That’s why this Revolut review went online to discover exactly what users think of this brand and their features.

The easier way to find reviews for this one comes from their apps. The Google Play Store currently has 4.5/5 stars based on over 1 million ratings, and those only echo a portion of the downloads this app has seen.

Noted for ideal money transfer, this app simplifies the process of travel and spending on an international level. Customers adore how this app simplifies financial decisions, making it a one-stop location for all things money.

It’s Revolut’s mission to keep things easy for customers and introduce them to a world of financial literacy.

“I have been using Revolut for almost 3 years. I think it’s really good for security… I use it abroad, exchange rates are brilliant, top up instantly, and then if you don’t spend all your foreign currency just change it back at the rate at the time, no commission and real exchange rates.”

The best part about reading through reviews is noting the lengthy experience of many of the users. With customers who have been with Revolut for two, three, even four years, it’s clear that the company has offered a level of control that traditional banks typically don’t.

Listening to their customers, this brand even takes time to acknowledge bugs and errors to better the overall experience of transactions and payments.

One customer took note of how far the brand has come by explaining that they’ve been “using this for two years! But, before it was a bit difficult to get money on it because it took one or two days to get your money on it, a year ago they fixed that with iDeal payment system, I could get my money there with no problem. Everything I’ve experienced was amazing.”

In addition to Google Play’s large numbers, Apple comes to the game with their own high reports of 4.9/5 stars based on over 133k ratings. These customers pile on heaps of praise for the features available. The one element often highlighted – control.

“You tap the card and about 3 seconds later you get a notification saying where and how much you spent. You can go through all the purchases you made and you can SEE where everything is going and makes you feel in control. The card controls from the app are amazing.”

Constantly providing notifications, offering security, and tracking of deposits and withdrawals, Revolut wants to put the responsibility of money back into the hands of the user and teach them to manage their own holdings without depending on bankers to do all the work.

Of course, we didn’t just want to look at the app stores for this one. Considering a more general platform, TrustPilot still manages to secure a solid status with 4.4/5 stars based on over 105k ratings.

Perfect for travel, many users side with this company as “it’s easy and the cheapest option” with no international fees on currency exchange ten times a month, withdrawals, and transfers.

Overall it seems as though the app itself does a good job of managing money.

Is Revolut Legit?

Understandably, not everyone would give this kind of business a glance. Rest assured, we’ve done some checking and this one seems legit.

All card transactions work through Mastercard or Visa networks, following the rules set in place by each.

Is Revolut Worth It?

Our Revolut review is giving this brand two thumbs up.

For those traveling or spending internationally, this seems like a prime solution to minimizing fees and improving financial flow.

Starting out strong with opening a Standard account with no-fee, we’d say Revolut is worth a shot for their low costs alone. Give them a try, start small, and then take a look at upgrading for the real perks.

Revolut Promotions & Discounts

At the time of writing this Revolut review, there are no running promotions.

Where to Buy Revolut

Revolut operates from their own space. This means everything occurs on revolut.com and the Revolut App, available from both the Apple and Google Play stores.

FAQ

Who owns Revolut?

Revolut is owned and operated by the founder Nik Storonsky.

Is Revolut better than a bank?

It’s difficult to determine whether Revolut should serve as a complete replacement for a bank. They do offer a simple setup, good security, and a range of currency exchange and app features.

At the same time, car and mortgage loans aren’t yet provided, so attachment to a bank makes those operations easier to handle.

Is Revolut broker good for beginners?

Revolut offers a great introduction to financial health and education for beginners.

Delivering a simple way to buy and exchange investments, this platform makes things easier through their low fees and simple setup.

Perfect for an initial education, this app is ready to help people learn how to make money work for them.

How do I deposit in Revolut?

This Revolut review found a number of ways to deposit funds to the account. Offering options through transfers, debit, and electronic wallets, it’s incredibly easy to add some cash to any account.

How to withdraw from Revolut?

Need to grab some cash last minute? Withdrawal has never been so simple. All customers need to do is:

- Go to the app

- Select Payments

- Select Bank Transfer

- Add to a bank account

- Choose the currency and amount

- Initiate the withdrawal

Customers can also withdraw from ATMs for limited to no fee depending on the machine.

What is Revolut’s Privacy Policy?

Don’t worry about privacy with this one as Revolut promises to keep customer information safe and secure at all times. They allow users to manage and review financial activity at all times, leaving control in the customer’s hands. Revolut’s full Privacy Policy is publicly available on their website.

How to Contact Revolut

Something not working as planned? Reach out to the company through their in-app chat feature.

“Please note that Revolut is frequently updating its products and features, see the Revolut Terms and Conditions for the latest offerings.”

The Revolut USA Prepaid Visa and Mastercard is issued by Metropolitan Commercial Bank pursuant to a license from Visa U.S.A. Inc. and Mastercard International and may be used everywhere Mastercard and Visa are accepted. Banking services are provided by Metropolitan Commercial Bank (Member FDIC). Revolut Technologies Inc. is a technology services provider and administrator of the card program.

Looking for other top brands? Check out these curated lists below:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review